P2P payment platforms have revolutionized the way we transfer money. However, with convenience comes the risk of human error. If you’ve ever found yourself in the unfortunate situation of sending money to the wrong person, you’re not alone. This comprehensive guide will walk you through the steps to potentially recover your funds and prevent future mishaps.

Contents

- 1 Understanding P2P Payments

- 2 Common Mistakes Leading to Wrong Payments

- 3 Immediate Steps to Take After a Wrong Payment

- 4 Contacting Your Payment Provider

- 5 Leveraging Customer Support

- 6 Filing a Dispute with Your Payment Provider

- 7 Involving Law Enforcement

- 8 Utilizing Social Media

- 9 Reaching Out to the Recipient

- 10 Exploring Third-Party Recovery Services

- 11 Preventing Future Mistakes

- 12 Choosing a Secure P2P Platform

- 13 Double-Checking Recipient Information

- 14 Using Two-Factor Authentication

- 15 Regularly Reviewing Your Account

- 16 10 FAQs

- 17 Conclusion

Understanding P2P Payments

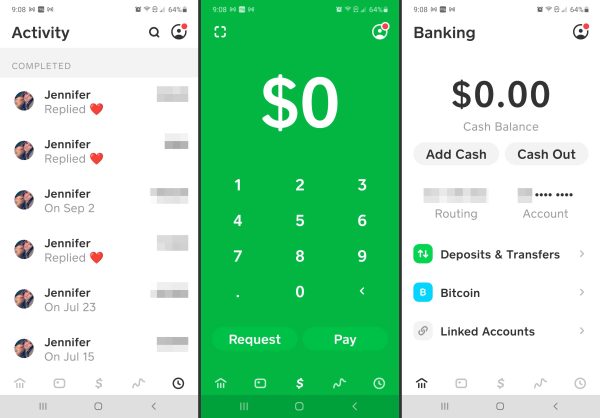

P2P payments allow individuals to transfer money directly to one another using mobile apps or online platforms. These services, such as Venmo, PayPal, and Cash App, have gained immense popularity due to their ease of use and instant transfer capabilities. However, the same features that make them convenient can also lead to errors if users aren’t careful.

To learn more about P2P, visit the website “what ia peer-to-peer?”

Common Mistakes Leading to Wrong Payments

Several factors can contribute to sending money to the unintended recipient:

- Mistyping the recipient’s username or phone number

- Selecting the wrong contact from your list

- Falling for scams or phishing attempts

- Autofill errors in payment fields

- Confusion between similar usernames

Understanding these common pitfalls is crucial in learning how can you get your money back if you send a p2p payment to the wrong person.

Immediate Steps to Take After a Wrong Payment

Time is of the essence when you realize you’ve sent money to the wrong person. Here’s what you should do right away:

- Don’t panic – keep a clear head to act swiftly

- Check if the payment has been processed or is still pending

- Try to cancel the transaction if it’s still in progress

- Document all details of the erroneous transaction

- Prepare to contact your payment provider immediately

Contacting Your Payment Provider

Reach out to your P2P payment service’s customer support as soon as possible. Most providers have dedicated channels for reporting incorrect payments. Be prepared with the following information:

- Transaction ID

- Date and time of the transaction

- Amount sent

- Intended recipient’s information

- Actual recipient’s information (if known)

The sooner you alert them, the better your chances of resolving the issue and potentially getting your money back.

Leveraging Customer Support

When dealing with customer support, remember these tips:

- Be polite but persistent

- Clearly explain the situation and your attempts to resolve it

- Ask about all available options for recovery

- Keep a record of all communications

- Follow up regularly if the issue isn’t resolved immediately

Effective communication with customer support is crucial when figuring out how can you get your money back if you send a p2p payment to the wrong person.

Filing a Dispute with Your Payment Provider

If initial contact doesn’t yield results, you may need to file a formal dispute. This process varies by provider but generally involves:

- Submitting a dispute form

- Providing additional documentation

- Explaining why the transaction was erroneous

- Detailing your attempts to resolve the issue

- Waiting for the provider’s investigation and decision

Be aware that this process can take several days to weeks, depending on the complexity of the case and the provider’s policies.

Involving Law Enforcement

In cases of significant amounts or suspected fraud, involving law enforcement might be necessary. Here’s what you need to know:

- File a police report with your local authorities

- Provide all relevant transaction details and communications

- Ask about the possibility of tracing the funds

- Inquire if they can assist in contacting the unintended recipient

- Be prepared for limited action in cases of simple mistakes

Remember, law enforcement involvement is typically a last resort when exploring how can you get your money back if you send a p2p payment to the wrong person.

Utilizing Social Media

In today’s connected world, social media can be a powerful tool for resolution:

- Use platform search functions to find the unintended recipient

- Reach out politely explaining the situation

- Be cautious about sharing personal or financial information

- Consider using the payment platform’s social media for assistance

- Be aware that public posts might attract scammers

While not a guaranteed solution, social media can sometimes lead to swift resolutions in cases of honest mistakes.

Reaching Out to the Recipient

If you can identify the person who received your payment by mistake, try contacting them directly:

- Craft a polite and clear message explaining the error

- Provide proof of the mistaken transaction

- Suggest easy ways for them to return the funds

- Be patient and understanding – they may be wary of scams

- Consider offering a small reward for their honesty and effort

Direct communication can often be the fastest way to resolve the issue, especially if the recipient is honest and willing to help.

Exploring Third-Party Recovery Services

Some companies specialize in helping people recover misdirected funds. Before using such services:

- Research the company’s reputation and success rate

- Understand their fee structure – often a percentage of recovered funds

- Be wary of upfront fees or guarantees that seem too good to be true

- Provide them with all relevant transaction details

- Maintain realistic expectations about the outcome

While these services can be helpful, they should be considered only after exhausting other options in your quest to figure out how can you get your money back if you send a p2p payment to the wrong person.

Preventing Future Mistakes

Prevention is always better than cure. Here are some strategies to avoid future misdirected payments:

- Double-check all recipient details before confirming

- Use recipient aliases or nicknames for frequent transfers

- Enable additional security features offered by your payment app

- Regularly update and clean your contact list

- Be cautious when making payments while distracted or in a hurry

Choosing a Secure P2P Platform

Not all P2P platforms are created equal. When selecting a service, consider:

- Robust security features and encryption

- User-friendly interface to minimize errors

- Strong customer support and dispute resolution processes

- Clear policies on misdirected payments

- Positive user reviews and reputation

Choosing the right platform can significantly reduce the risk of errors and improve your chances of recovery if mistakes occur.

Double-Checking Recipient Information

Make it a habit to verify recipient details before sending money:

- Confirm the username or phone number

- Check the profile picture if available

- Use the “Add a note” feature to confirm the purpose

- For large amounts, consider sending a small test transaction first

- Ask the recipient to confirm their details via another method

These extra steps can save you from the headache of figuring out how can you get your money back if you send a p2p payment to the wrong person.

Using Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security:

- Enable 2FA on your P2P payment accounts

- Use app-based authenticators rather than SMS when possible

- Consider biometric authentication if available

- Never share your 2FA codes with anyone

- Regularly update your 2FA settings

While 2FA won’t prevent misdirected payments, it can protect your account from unauthorized access and potential scams.

Regularly Reviewing Your Account

Stay vigilant by regularly monitoring your P2P account:

- Set up transaction notifications

- Review your transaction history frequently

- Keep your contact list updated and organized

- Check for any unfamiliar or suspicious activity

- Report any discrepancies to your provider immediately

Regular reviews can help you catch and address issues quickly, improving your chances of recovery.

10 FAQs

To further address common concerns about how can you get your money back if you send a p2p payment to the wrong person, here are some frequently asked questions:

Q1: Is it possible to cancel a P2P payment after it’s been sent? A: It depends on the platform and whether the payment has been processed. Some services allow cancellation of pending payments, but once processed, it’s usually final.

Q2: How long do I have to report a misdirected payment? A: Report it immediately. Most platforms have time limits for disputes, often ranging from 60 to 180 days.

Q3: Can my bank help if I sent money to the wrong person via a P2P app? A: Banks have limited ability to reverse P2P transactions. Your best bet is to work directly with the P2P service provider.

Q4: What if the wrong recipient refuses to return the money? A: If they refuse, you may need to escalate to the P2P provider’s dispute resolution process or consider legal action for larger amounts.

Q5: Are there any legal protections for misdirected P2P payments? A: Legal protections vary by country and circumstance. In the U.S., P2P payments are often treated like cash transactions, with limited protections.

Q6: Can I get my money back if I sent it to a scammer? A: Recovery can be challenging in scam cases. Report it to your P2P provider, local authorities, and consider filing a report with the FTC.

Q7: How effective are third-party recovery services? A: Results vary. While some have success, be cautious of upfront fees and unrealistic promises.

Q8: What information should I never share when trying to recover misdirected funds? A: Never share your account password, full credit card numbers, or social security number during the recovery process.

Q9: Can I prevent my P2P app from autofilling recipient information? A: Most apps allow you to turn off autofill features in the settings. This can help prevent accidental selections.

Q10: Is it safe to use P2P payment apps for business transactions? A: Many P2P apps are designed for personal use and may offer limited protections for business transactions. Consider using business-specific payment solutions for added security.

Conclusion

Navigating the process of recovering misdirected P2P payments can be challenging, but it’s not impossible. By acting quickly, communicating effectively with all parties involved, and leveraging the available tools and resources, you can increase your chances of a positive outcome. Remember, the key to success often lies in swift action and persistence.

As P2P payment platforms continue to evolve, so too will the mechanisms for protecting users from errors and fraud. Stay informed about your chosen platform’s policies and security features, and always prioritize caution when sending money online.

By following the steps outlined in this guide and remaining vigilant in your digital transactions, you’ll be well-equipped to handle the unfortunate situation of sending money to the wrong person. And hopefully, with these preventive measures in place, you’ll rarely need to ask, “how can you get your money back if you send a p2p payment to the wrong person?“

Stay safe, stay informed, and transact with confidence in the digital age.