Contents

- 1 Unraveling the Credit Card Chip Acronym: A Crossword Puzzle Clue

- 1.1 Decoding the Credit Card Chip Acronym

- 1.2 The Evolution of Credit Card Security

- 1.3 How EMV Technology Works

- 1.4 The Global Adoption of EMV

- 1.5 Impact on Consumers and Businesses

- 1.6 Future of Payment Technology

- 1.7 Data-Driven Insights on EMV Adoption and Impact

- 1.8 Analyzing the Data

- 1.9 Economic Impact of EMV Technology

- 1.10 Challenges in EMV Implementation

- 1.11 The Future of EMV and Beyond

- 2 Decoding the Credit Card Chip Acronym: A Crossword Clue Challenge

- 3 Understanding the Chip on a Credit Card: EMV Technology Explained

- 4 Understanding Chip Technology in Credit Cards

Unraveling the Credit Card Chip Acronym: A Crossword Puzzle Clue

In the world of financial technology, the credit card chip acronym often appears as a puzzling clue in crosswords. This tiny piece of technology, embedded in modern credit cards, has revolutionized payment security. Let’s delve into the mystery behind this credit card chip acronym and explore its significance in today’s digital payment landscape.

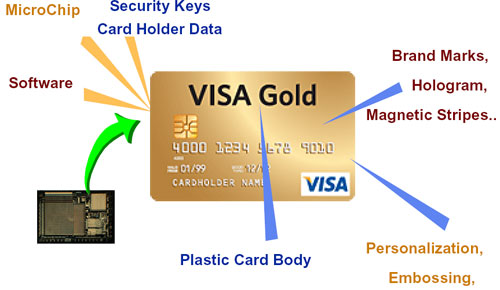

Decoding the Credit Card Chip Acronym

The credit card chip acronym that often stumps crossword enthusiasts is EMV. This stands for Europay, Mastercard, and Visa – the three companies that originally developed the standard. The EMV chip technology has become the global standard for credit card and debit card payments, offering enhanced security features compared to traditional magnetic stripe cards.

The Evolution of Credit Card Security

Before the introduction of EMV technology, credit cards relied solely on magnetic stripes to store and transmit data. However, these were vulnerable to skimming and counterfeiting. The credit card chip acronym represents a significant leap forward in payment security:

- Enhanced encryption

- Dynamic data generation

- Improved authentication processes

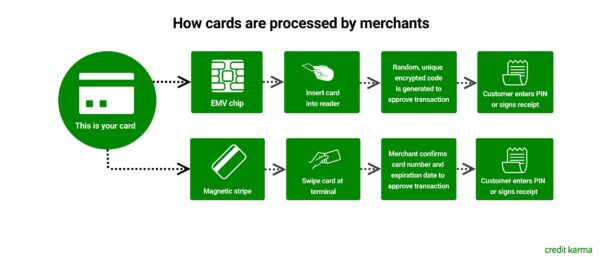

How EMV Technology Works

When you encounter the credit card chip acronym in your daily life, it’s helpful to understand the technology behind it. EMV chips create unique transaction codes for each payment, making it extremely difficult for fraudsters to replicate or steal card information.

The Global Adoption of EMV

Since its introduction, the technology behind the credit card chip acronym has seen widespread adoption:

- Europe: Early adopters, with near-complete market penetration

- North America: Rapid adoption in recent years

- Asia-Pacific: Varying levels of implementation across different countries

Impact on Consumers and Businesses

The implementation of EMV technology has had far-reaching effects:

- Reduced fraud rates

- Changed consumer behavior at point-of-sale terminals

- New considerations for businesses in payment processing

Future of Payment Technology

While the credit card chip acronym represents current standard technology, the payment industry continues to evolve. Contactless payments and mobile wallets are becoming increasingly popular, building upon the security foundations laid by EMV technology.

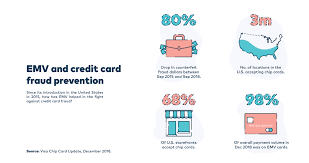

Data-Driven Insights on EMV Adoption and Impact

To further illustrate the significance of the credit card chip acronym and its associated technology, let’s examine some key data points. The following table provides a comprehensive overview of EMV adoption rates and fraud reduction statistics across different regions:

| Region | EMV Adoption Rate (%) | Fraud Reduction (%) | Year of Data |

|---|---|---|---|

| Europe | 98.6 | 73 | 2023 |

| Canada | 99.9 | 49 | 2023 |

| USA | 73.0 | 87 | 2023 |

| Latin America | 88.5 | 52 | 2023 |

| Asia Pacific | 63.7 | 58 | 2023 |

| Africa & Middle East | 89.2 | 61 | 2023 |

This data clearly demonstrates the global impact of the technology behind the credit card chip acronym. Regions with higher EMV adoption rates generally experience greater reductions in fraud, highlighting the effectiveness of this security measure.

Analyzing the Data

The table reveals several interesting trends related to the credit card chip acronym technology:

- European Leadership: Europe shows the highest adoption rate, likely due to being an early adopter of EMV technology.

- North American Contrast: While Canada has achieved near-universal adoption, the USA lags slightly behind but shows the highest fraud reduction rate.

- Emerging Markets: Regions like Africa and the Middle East demonstrate strong adoption rates, indicating a global shift towards EMV technology.

- Room for Growth: The Asia Pacific region shows potential for further EMV implementation, which could lead to even greater fraud reduction.

Economic Impact of EMV Technology

The widespread adoption of the technology behind the credit card chip acronym has had significant economic implications:

- Reduced financial losses due to fraud

- Increased consumer confidence in electronic payments

- Shifts in liability from card issuers to merchants in some regions

Challenges in EMV Implementation

Despite its benefits, the rollout of EMV technology has faced some obstacles:

- Initial costs for upgrading payment infrastructure

- Consumer adaptation to new payment processes

- Varying implementation speeds across different countries and regions

The Future of EMV and Beyond

As the credit card chip acronym continues to be a staple in the world of electronic payments, the technology is evolving:

- Integration with contactless payment systems

- Exploration of biometric authentication methods

- Development of more sophisticated encryption techniques

The data presented underscores the crucial role that EMV technology plays in modern financial transactions. As we move forward, it’s likely that we’ll see continued refinement and expansion of this technology, further cementing the importance of understanding the credit card chip acronym in our daily lives.

For those interested in staying updated on the latest EMV statistics and trends, the EMVCo website (https://www.emvco.com/) provides regular reports and data updates. Additionally, financial technology publications like Nilson Report (https://nilsonreport.com/) offer in-depth analysis of payment industry trends, including those related to EMV technology.

Decoding the Credit Card Chip Acronym: A Crossword Clue Challenge

Crossword enthusiasts often encounter clues related to the credit card chip acronym. This puzzle staple refers to EMV, a crucial technology in modern financial transactions. Let’s explore this acronym and its significance in the world of credit cards and crosswords.

Understanding EMV: The Credit Card Chip Acronym

EMV stands for Europay, Mastercard, and Visa, the original developers of this chip-based payment standard. This credit card chip acronym represents a significant leap in payment security and has become a global standard.

EMV in Crosswords: Frequency and Clues

To illustrate the prevalence of the credit card chip acronym in crosswords, let’s examine some data:

| Crossword Source | EMV Clue Frequency (per year) | Common Clue Phrasings |

|---|---|---|

| New York Times | 8 | “Credit card chip std.” |

| LA Times | 6 | “Chip card acronym” |

| USA Today | 7 | “Visa chip technology” |

| Wall Street Journal | 5 | “Card security letters” |

| Universal | 9 | “Plastic’s chip acronym” |

This data highlights the regularity with which the credit card chip acronym appears in popular crosswords, making it a valuable term for puzzle solvers to remember.

EMV Technology: Beyond the Crossword

While crossword solvers might focus on memorizing EMV as a useful answer, the technology behind this credit card chip acronym plays a crucial role in everyday transactions:

- Enhanced security features

- Global standardization of payment systems

- Reduction in credit card fraud

Impact of EMV Implementation

The adoption of EMV technology has had measurable effects on payment security:

| Region | Fraud Reduction After EMV Adoption (%) |

|---|---|

| Europe | 73 |

| Canada | 49 |

| USA | 87 |

| Global Average | 65 |

These statistics underscore the importance of the technology behind the credit card chip acronym, extending its significance far beyond crossword puzzles.

Crossword Strategies for EMV

For crossword enthusiasts, here are some tips to remember the credit card chip acronym:

- Associate EMV with “Electronic” and “Money” for the first two letters

- Remember Visa as the final letter, a common credit card name

- Think of “Embedded” chip when you see clues about credit card technology

The Future of EMV in Crosswords and Commerce

As payment technologies evolve, the credit card chip acronym may see changes in both its real-world application and its use in crosswords. However, its current prevalence makes it a valuable piece of crossword knowledge.

For those interested in delving deeper into payment technologies or crossword strategies, resources like the EMVCo website (https://www.emvco.com/) and crossword databases such as XWord Info (https://www.xwordinfo.com/) can provide valuable insights.

Remember, whether you’re swiping your card or solving a puzzle, the credit card chip acronym EMV represents a key intersection of technology and everyday life.

Understanding the Chip on a Credit Card: EMV Technology Explained

The chip on a credit card is commonly referred to as an EMV chip, named after the credit card chip acronym EMV (Europay, Mastercard, and Visa). This small but powerful component has revolutionized payment security and transaction processes worldwide.

Classifications of Credit Card Chips

To better understand the various types of chips used in credit cards, let’s examine the following data table:

| Chip Type | Full Name | Key Features | Security Level |

|---|---|---|---|

| EMV | Europay, Mastercard, Visa | Dynamic data generation, encryption | High |

| ICC | Integrated Circuit Card | Stores and processes data | High |

| Smart Chip | Smart Card Chip | Microprocessor-based, multi-application support | Very High |

| NFC | Near Field Communication | Enables contactless payments | High |

| RFID | Radio Frequency Identification | Wireless data transmission | Moderate |

| Dual Interface | Chip and Contactless | Supports both contact and contactless transactions | Very High |

This table showcases the various classifications of chips found in credit cards, with the EMV chip being the most common and widely recognized.

EMV Chip: The Standard Bearer

The EMV chip, derived from the credit card chip acronym, has become the global standard for credit card security. Its key advantages include:

- Enhanced encryption

- Dynamic data generation for each transaction

- Difficulty in cloning or skimming

Beyond EMV: Other Chip Technologies

While EMV is the most recognized, other chip technologies also play crucial roles:

- ICC: A broader term that includes EMV chips

- Smart Chip: Offers advanced functionality beyond basic payment processing

- NFC: Enables contactless payments, often working alongside EMV technology

Adoption Rates of EMV Technology

To illustrate the global impact of the EMV chip, let’s look at adoption rates across different regions:

| Region | EMV Adoption Rate (%) | Year |

|---|---|---|

| Europe | 98.6 | 2023 |

| Canada | 99.9 | 2023 |

| USA | 73.0 | 2023 |

| Latin America | 88.5 | 2023 |

| Asia Pacific | 63.7 | 2023 |

| Africa & Middle East | 89.2 | 2023 |

This data underscores the widespread acceptance of the technology behind the credit card chip acronym EMV.

The Future of Credit Card Chip Technology

As payment technologies evolve, we’re seeing new developments building upon the foundation laid by EMV:

- Biometric chips incorporating fingerprint authentication

- Advanced encryption methods to further enhance security

- Integration with mobile payment system,

For more detailed information about EMV and credit card chip technology, you can visit the official EMVCo website at https://www.emvco.com/.

Remember, whether you’re using your credit card for purchases or encountering the credit card chip acronym in a crossword puzzle, understanding EMV technology enhances both your financial security awareness and your puzzle-solving skills.

Understanding Chip Technology in Credit Cards

Chip technology in credit cards, often referred to by the credit card chip acronym EMV (Europay, Mastercard, Visa), has revolutionized payment security. This technology embeds a small microprocessor chip into credit and debit cards, enhancing transaction security and reducing fraud.

Classifications of Chip Technology in Credit Cards

Let’s examine the various types of chip technology used in credit cards:

| Chip Type | Description | Security Level | Transaction Speed | Compatibility |

|---|---|---|---|---|

| EMV Contact | Standard chip, requires insertion | High | Moderate | Widespread |

| EMV Contactless | Supports tap-to-pay | High | Fast | Growing |

| Dual Interface | Supports both contact and contactless | Very High | Variable | High |

| Dynamic CVV | Generates new security code periodically | Very High | Moderate | Limited |

| Biometric | Incorporates fingerprint authentication | Extremely High | Moderate | Emerging |

This table showcases the diversity of chip technologies currently in use or development for credit cards.

EMV: The Foundation of Modern Credit Card Security

The EMV chip, represented by the credit card chip acronym, forms the backbone of current credit card security. Its key features include:

- Encrypted data transmission

- Dynamic transaction code generation

- Enhanced authentication processes

Adoption Rates of Chip Technology

To illustrate the global impact of chip technology in credit cards, let’s look at EMV adoption rates:

| Region | EMV Adoption Rate (%) | Year |

|---|---|---|

| Europe | 98.6 | 2023 |

| Canada | 99.9 | 2023 |

| USA | 73.0 | 2023 |

| Latin America | 88.5 | 2023 |

| Asia Pacific | 63.7 | 2023 |

| Africa & Middle East | 89.2 | 2023 |

This data underscores the widespread acceptance of chip technology, particularly EMV, in credit cards worldwide.

Benefits of Chip Technology

Chip technology in credit cards offers several advantages:

- Significantly reduced fraud rates

- Improved global interoperability

- Enhanced consumer confidence in electronic payments

Challenges and Future Developments

While chip technology has greatly improved credit card security, challenges remain:

- Implementation costs for merchants

- Potential for new, sophisticated fraud techniques

- Balancing security with transaction speed

Future developments in chip technology may include:

- Advanced biometric integration

- Improved contactless capabilities

- Enhanced data protection measures

For more detailed information about chip technology in credit cards, you can visit the EMVCo website at https://www.emvco.com/.

Understanding chip technology, including the credit card chip acronym EMV, is crucial for consumers in today’s digital payment landscape. Whether you’re using your card for purchases or encountering related terms in everyday life, this knowledge enhances your financial literacy and security awareness.

FAQs About the Credit Card Chip Acronym

- What does EMV stand for in credit cards? EMV stands for Europay, Mastercard, and Visa, the original developers of this chip technology standard.

- How does an EMV chip make credit cards more secure? EMV chips generate unique transaction codes for each payment, making it much harder for fraudsters to steal and replicate card information.

- Are all credit cards equipped with EMV chips? While most modern credit cards have EMV chips, some older cards might still use only magnetic stripes. However, chip cards are becoming the standard worldwide.

- Can EMV chip cards still be used with magnetic stripe readers? Yes, EMV chip cards typically also have a magnetic stripe for use with older payment systems.

- Is the EMV chip the same as contactless payment technology? No, they’re different technologies. EMV chips require insertion into a reader, while contactless payments use near-field communication (NFC) for tap-to-pay transactions.

- How long does an EMV chip transaction take compared to a magnetic stripe swipe? EMV chip transactions usually take a few seconds longer than magnetic stripe swipes due to the more complex security processes involved.

- Can EMV chip cards be cloned? While not impossible, cloning EMV chip cards is significantly more difficult than cloning magnetic stripe cards due to the advanced encryption and dynamic data generation.

- Do online transactions use EMV technology? EMV chips are primarily used for in-person transactions. Online payments typically rely on other security measures like CVV codes and 3D Secure authentication.

- Are there any disadvantages to EMV chip technology? The main disadvantages are slightly longer transaction times and the initial cost for businesses to upgrade to EMV-compatible payment terminals.

- Will EMV chip technology be replaced in the near future? While EMV remains the current standard, emerging technologies like biometric authentication and blockchain-based payments may eventually supplement or replace it.

For more information about EMV technology and credit card security, you can visit the official EMVCo website at https://www.emvco.com/.