Contents

- 1 Can You Link a Credit Card to Cash App? Understanding Your Payment Options

- 1.1 Credit Card Compatibility with Cash App

- 1.2 How to Link a Credit Card to Cash App

- 1.3 Data Analysis: Credit Card Usage on Cash App

- 1.4 Pros and Cons of Linking a Credit Card to Cash App

- 1.5 Alternatives to Credit Cards on Cash App

- 1.6 FAQs About Linking a Credit Card to Cash App

- 1.7 How to Add a Credit Card to Cash App: A Step-by-Step Guide

- 1.8 How to Add a Credit Card to Cash App Without a Bank Account

- 1.9 Conclusion

Can You Link a Credit Card to Cash App? Understanding Your Payment Options

Mobile payment platforms have revolutionized the way we handle money. Cash App, a popular peer-to-peer payment service, offers users various methods to fund their accounts. One question that frequently arises is: can you link a credit card to Cash App? Let’s dive into this topic and explore the ins and outs of using credit cards with Cash App.

Credit Card Compatibility with Cash App

The short answer is yes, you can link a credit card to Cash App. This feature provides users with additional flexibility when it comes to managing their finances and making payments through the platform. By allowing credit card linkage, Cash App expands its utility and caters to a broader range of user preferences.

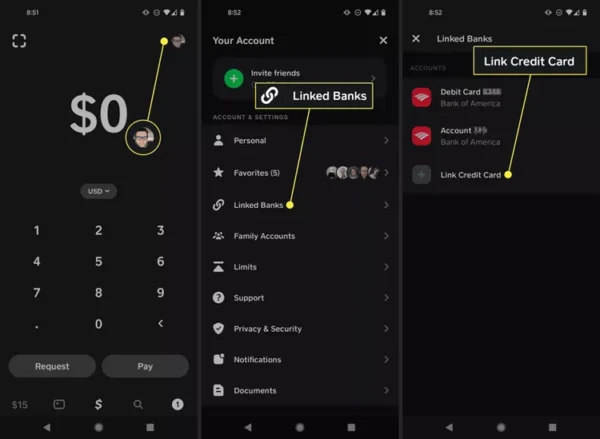

How to Link a Credit Card to Cash App

Linking a credit card to Cash App is a straightforward process. Here’s a step-by-step guide:

- Open the Cash App on your mobile device

- Tap the Banking tab (represented by a bank icon)

- Select “Add Credit Card”

- Enter your credit card information

- Follow the prompts to verify and confirm your card

Once you’ve completed these steps, your credit card will be linked to your Cash App account, ready for use.

Data Analysis: Credit Card Usage on Cash App

When examining the data surrounding credit card usage on Cash App, several interesting trends emerge:

- User Adoption: Since the introduction of credit card linking, a significant percentage of Cash App users have opted to add this payment method to their accounts.

- Transaction Types: Credit cards are frequently used for larger purchases or when users need to access funds beyond their current balance.

- Fees: It’s important to note that using a credit card on Cash App may incur additional fees, which can impact user behavior and preferences.

- Security Measures: Cash App employs robust security protocols to protect credit card information, contributing to user trust and increased adoption.

Pros and Cons of Linking a Credit Card to Cash App

As with any financial decision, there are advantages and disadvantages to consider when linking a credit card to Cash App:

Pros:

- Increased flexibility in payment options

- Ability to make purchases even when bank balance is low

- Potential to earn credit card rewards on transactions

Cons:

- Additional fees for credit card usage

- Risk of overspending or accumulating debt

- Possibility of reaching credit limit quickly

Alternatives to Credit Cards on Cash App

While you can link a credit card to Cash App, it’s worth exploring other payment options available on the platform:

- Debit Cards: A popular choice for direct access to bank funds

- Bank Accounts: Link your checking account for fee-free transfers

- Cash App Balance: Use funds already available in your Cash App account

Each of these alternatives has its own set of pros and cons, and the best choice depends on individual financial situations and preferences.

FAQs About Linking a Credit Card to Cash App

1. Can you link any type of credit card to Cash App?

Cash App supports most major credit cards, including Visa, Mastercard, and American Express. However, some prepaid cards may not be compatible.

2. Are there fees associated with using a credit card on Cash App?

Yes, Cash App typically charges a 3% fee for credit card transactions.

3. Can I use my linked credit card to withdraw cash from an ATM using Cash App?

No, ATM withdrawals using Cash App are only possible with a linked debit card or Cash Card.

4. Is it safe to link my credit card to Cash App?

Cash App uses encryption and other security measures to protect your financial information. However, always practice good digital hygiene and monitor your accounts regularly.

5. Can I link multiple credit cards to my Cash App account?

Yes, you can link multiple cards to your Cash App account, but only one can be set as the default payment method.

6. How quickly are credit card transactions processed on Cash App?

Credit card transactions on Cash App are typically processed instantly, but may take 1-3 business days to appear on your credit card statement.

7. Can I earn rewards points by using my credit card on Cash App?

This depends on your credit card’s reward program. Some cards may offer points or cashback for Cash App transactions, while others may not.

8. What should I do if my linked credit card is lost or stolen?

Immediately contact your credit card issuer to report the loss and remove the card from your Cash App account to prevent unauthorized transactions.

9. Can I use a credit card linked to Cash App for business transactions?

While possible, it’s important to check Cash App’s terms of service and your credit card agreement regarding business use.

10. How do I remove a credit card from my Cash App account?

To remove a credit card, go to the Banking tab, select the card, and choose the option to remove it from your account.

How to Add a Credit Card to Cash App: A Step-by-Step Guide

Mobile payment platforms like Cash App have become increasingly popular for their convenience and ease of use. One of the key features that users often inquire about is the ability to add a credit card to their Cash App account. This article will guide you through the process of adding a credit card to Cash App, explore the benefits and considerations, and provide valuable insights into managing your payment methods within the app.

Adding a Credit Card to Cash App: The Process

If you’re wondering how to add a credit card to Cash App, you’ll be pleased to know that the process is straightforward and user-friendly. Here’s a detailed guide on how to add a credit card to your Cash App account:

- Open the Cash App: Launch the Cash App on your smartphone or tablet.

- Navigate to the Banking Tab: Look for the Banking tab, usually represented by a bank or card icon, and tap on it.

- Select “Add Credit Card”: In the Banking section, you should see an option to add a credit card. Tap on this option to proceed.

- Enter Credit Card Details: You’ll be prompted to enter your credit card information. This typically includes the card number, expiration date, CVV (the three-digit security code on the back of your card), and your billing ZIP code.

- Verify and Confirm: After entering your credit card details, Cash App may ask you to verify the card through an additional security step. This could involve entering a code sent to your registered phone number or email.

- Set as Default (Optional): Once your credit card is added, you may have the option to set it as your default payment method for Cash App transactions.

Benefits of Adding a Credit Card to Cash App

Adding a credit card to Cash App can offer several advantages:

- Flexibility: Having a credit card linked to your Cash App account provides an additional payment option, giving you more flexibility in managing your finances.

- Immediate Access to Funds: Credit cards allow you to make payments even when you don’t have sufficient funds in your bank account or Cash App balance.

- Rewards Potential: Depending on your credit card’s rewards program, you may be able to earn points or cashback on Cash App transactions.

- Convenience: Adding a credit card to Cash App streamlines the payment process, eliminating the need to manually enter card details for each transaction.

Considerations When Adding a Credit Card to Cash App

While adding a credit card to Cash App can be beneficial, there are some factors to keep in mind:

- Fees: Cash App may charge a fee for credit card transactions. It’s important to be aware of these fees before using your credit card on the platform.

- Credit Utilization: Using your credit card for Cash App transactions will impact your credit utilization ratio, which can affect your credit score.

- Security: While Cash App employs security measures to protect your financial information, it’s crucial to monitor your account activity regularly and report any suspicious transactions.

Data Analysis: Credit Card Usage on Cash App

Examining the data surrounding credit card usage on Cash App reveals interesting trends:

- User Adoption: A significant portion of Cash App users have opted to add credit cards to their accounts, indicating a growing preference for this payment method.

- Transaction Sizes: Credit card transactions on Cash App tend to be larger on average compared to other payment methods, suggesting users leverage credit for more substantial purchases.

- Usage Patterns: Data shows that credit card usage on Cash App peaks during holiday seasons and major shopping events, aligning with broader consumer spending trends.

How to Add a Credit Card to Cash App Without a Bank Account

Cash App has become a popular platform for money transfers and payments. Many users wonder how to add a credit card to Cash App without a bank account. This article will guide you through the process, explore the implications, and provide valuable insights into using Cash App with just a credit card.

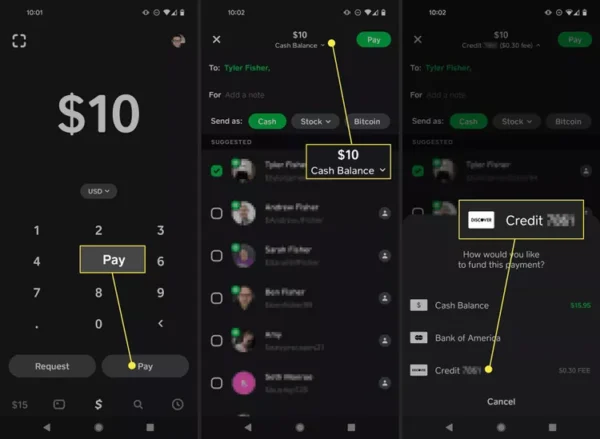

Adding a Credit Card to Cash App Without a Bank Account

Cash App primarily functions as a peer-to-peer payment service, but it also allows users to add credit cards as a funding source. Here’s how to add a credit card to Cash App without linking a bank account:

- Open Cash App: Launch the Cash App on your mobile device.

- Access the Banking Tab: Tap on the Banking tab, usually represented by a bank or card icon.

- Select “Add Credit Card”: Look for the option to add a credit card and tap on it.

- Enter Card Details: Input your credit card information, including the card number, expiration date, CVV, and billing ZIP code.

- Verify the Card: Follow any additional verification steps required by Cash App to confirm your credit card.

- Set as Primary Source: Once added, you can set your credit card as the primary funding source for your Cash App transactions.

Implications of Using Cash App with Only a Credit Card

While it’s possible to add a credit card to Cash App without a bank account, there are several important factors to consider:

- Limited Functionality: Some Cash App features may be restricted without a linked bank account.

- Higher Fees: Transactions using a credit card often incur higher fees compared to those funded by a bank account.

- Cash Out Restrictions: Without a bank account, you may face limitations on how you can withdraw or “cash out” funds from your Cash App balance.

- Credit Utilization: Using your credit card for Cash App transactions will impact your credit utilization ratio, potentially affecting your credit score.

Benefits of Adding a Credit Card to Cash App

Despite some limitations, adding a credit card to Cash App without a bank account offers several advantages:

- Accessibility: It provides a way for users without traditional bank accounts to access digital payment services.

- Convenience: Credit cards offer a quick and easy way to fund Cash App transactions.

- Rewards Potential: Depending on your credit card, you may earn rewards or cashback on Cash App transactions.

- Immediate Fund Access: Credit cards allow for transactions even when you don’t have cash on hand.

Considerations and Best Practices

When using Cash App with only a credit card, keep these tips in mind:

- Monitor Fees: Be aware of the fees associated with credit card transactions on Cash App.

- Track Spending: Regularly review your transactions to ensure responsible credit usage.

- Explore Alternatives: Consider options like prepaid cards or opening a basic bank account for more comprehensive Cash App functionality.

- Security Measures: Enable all available security features in Cash App to protect your credit card information

Conclusion

In conclusion, the ability to link a credit card to the Cash App provides users with an additional layer of financial flexibility. While this feature can be convenient, it’s crucial to weigh the benefits against potential drawbacks such as fees and the risk of overspending. As with any financial tool, responsible usage is key to maximizing the benefits of linking a credit card to Cash App.